Audit Committee

Each term of the Company's Audit Committee shall be composed of all independent directors, one of whom shall serve as the convener, and at least one member shall possess accounting or financial expertise.

Members of the Second Audit Committee

Convener: Independent Director Lai Mingyang

Members: Independent Director Wu Liyu and Independent Director Chen Junzhong

Audit Committee Responsibilities

Establish or amend the internal control system in accordance with Article 14-1 of the Securities and Exchange Act.

● Evaluate the effectiveness of the internal control system.

● Establish or amend the procedures for handling significant financial transactions such as the acquisition or disposal of assets, derivatives trading, lending funds to others, or endorsing or providing guarantees for others in accordance with Article 36-1 of the Securities and Exchange Act.

● Matters involving a director's personal interests.

● Significant asset or derivatives trading.

● Significant lending, endorsement, or provision of guarantees.

● Offering, issuance, or private placement of equity securities.

● Appointment, dismissal, or remuneration of certified public accountants.

● Appointment and dismissal of the head of finance, accounting, or internal audit.

● Annual financial report signed or stamped by the Chairman, the General Manager, and the Chief Accountant, and the second quarter financial report audited and certified by a CPA.

● Other significant matters as required by the company or competent authorities.

The Audit Committee will meet at least quarterly, with two meetings in 2025, on May 8 and March 13, and six meetings in 2024, on December 20, November 12, August 9, May 13, March 12, and January 25. The Committee will review and approve proposals and submit them to the Board for resolution.

Audit Committee Annual Work Focus

● Review of financial statements.

● Audit and accounting policies and procedures.

● Internal control systems and related policies and procedures.

● Significant asset transactions.

● Matters involving personal interests of directors.

● Regulatory compliance.

● Review of the qualifications, independence, and performance evaluation of certified public accountants.

● Appointment, dismissal, and remuneration of certified public accountants.

● Audit Committee Performance of Duties, etc.

(1) Review of Financial Statements

The Board of Directors submitted the 2014 Annual Business Report, Individual Financial Statements, Consolidated Financial Statements, and Profit Appropriation Proposal. The financial statements have been audited by Ms. Lin Su-wen and Ms. Liu Hui-yuan of Ernst & Young, who have issued an unqualified audit opinion.

The Audit Committee reviewed the aforementioned business report, individual financial statements, consolidated financial statements, and profit appropriation proposal and found no discrepancies.

(2) Evaluation of the Effectiveness of the Internal Control System

The Audit Committee evaluated the effectiveness of the Company's internal control system policies and procedures and reviewed the Company's audit department, certifying accounting firm, and management's periodic reports.

(3) Appointment, Dismissal, Remuneration, Independence, and Performance Evaluation of the certifying accounting firm

The Audit Committee is responsible for overseeing the independence of the certifying accounting firm to ensure the fairness of the financial statements. On March 13, 2025, this committee approved the replacement of the certifying accountants for the financial statements in conjunction with the internal restructuring of Ernst & Young, the 2015 independence and competency assessment of the Company's certifying accountants, and the pre-approval of the 2025 list of non-assurance services and their independence assessment.

For details on the Committee's operations, please refer to the Company's annual reports and this website.

Remuneration Committee

Main Responsibilities of this Committee

(1) Establish and regularly review the policies, systems, standards, and structures for the performance evaluation and compensation of Directors and Managers.

(2) Regularly evaluate and determine the compensation of Directors and Managers.

The Compensation Committee will meet at least twice annually: once on 3/13, 2025; three times in 2024 on 12/20, 8/9, and 3/12; and twice in 2023 on 12/21 and 3/22. The Committee will submit resolutions to the Board of Directors for deliberation.

Sustainability Committee

Sustainability Committee Members

Chairman: Independent Director Lai Mingyang

Members: Independent Director Wu Liyu, Independent Director Chen Junzhong

The Company established the Sustainability Committee on December 21, 2023. It is composed of all independent directors. The convener of the committee, Lai Mingyang, has expertise in sustainability, corporate governance, finance and auditing, which meets the professional capabilities required of the committee. He is responsible for promoting the Company's sustainable development work.

Sustainability Committee Organization Chart

The Sustainability Committee shall hold at least one meeting per year, and will hold one meeting on December 20, 2024, and report the key points of the meeting to the Board of Directors.

Key Work Points of the Sustainability Committee

(1) Establishment of sustainable development policy.

(2) Establishment of annual sustainable development plan and strategic direction.

(3) Tracking and reviewing the implementation and effectiveness of sustainable development, and reporting to the Board of Directors.

(4) Decisions on other matters related to sustainable development.

This group is primarily responsible for formulating and implementing the Group's ESG development plan in line with the Group's operational strategy, overseeing the Group's ESG performance, strategies, policies, goals, regulations, and annual progress. It also coordinates resource integration between the ESG Committee, internal business units, and functional departments.

ESG Working Group

Led by the ESG Head and affiliated with the ESG Committee, this group is responsible for implementing ESG standards and measures, identifying material ESG issues, conducting gap analyses, and implementing improvement proposals. It assists all sites in addressing material ESG issues within the Group and responding to client and third-party ESG assessments. It is primarily responsible for developing the Group's ESG organizational structure and ESG policy, and establishing communication and coordination channels with stakeholders. It assesses ESG-related risks and provides solutions to strengthen the company's ability to address these risks.

The ESG Committee has three working groups responsible for implementing ESG matters: the Environmental Working Group, the Social Working Group, and the Governance Working Group. These groups set short, medium, and long-term goals and liaise with different sites and departments to implement ESG projects.

Promoting Sustainable Development Implementation

2024 推動永續發展執行情形

2024 推動永續發展執行情形

Functional Committee Operations

Audit Committee

2024 年審計委員會運作情形

2024 年審計委員會運作情形

2023 年審計委員會運作情形

2023 年審計委員會運作情形

Remuneration Committee

2024 年薪資報酬委員會運作情形

2024 年薪資報酬委員會運作情形

2023 年薪資報酬委員會運作情形

2023 年薪資報酬委員會運作情形

Sustainability Committee

2024 年永續發展委員會運作情形

2024 年永續發展委員會運作情形

Risk Management Committee

2024 年風險管理委員會運作情形

2024 年風險管理委員會運作情形

Risk Management and Operational Status

Risk Management Policies and Procedures

To ensure that our risk management operations have clear guidance and effectively control risks, the Company established the "Risk Management Policy and Procedures" in 2023. We regularly review the policy and integrate it with risk assessments to ensure its adequacy and support comprehensive risk management.

Every year, department heads conduct risk factor identification to identify relevant risks that may affect the company's sustainable development and select risk management areas. Based on the latest internal audit development requirements and standards, we monitor potential risks and implement preventive measures to strengthen risk management. We formulate and implement risk management strategies for various risks, covering management objectives, organizational structure, responsibilities, and risk management procedures, to control all risks arising from business activities within acceptable levels.

Risk Management Scope

To ensure the Company's normal operations and achieve sustainable growth, the Company proactively and cost-effectively integrates and manages all potential strategic, operational, financial, and hazard risks that could impact operations and profitability. Regular group risk assessments utilize a risk matrix to understand the frequency of risk events and the severity of their impact on the Company's operations. Risk priorities and risk levels are defined, and corresponding risk management strategies are implemented based on the risk level.

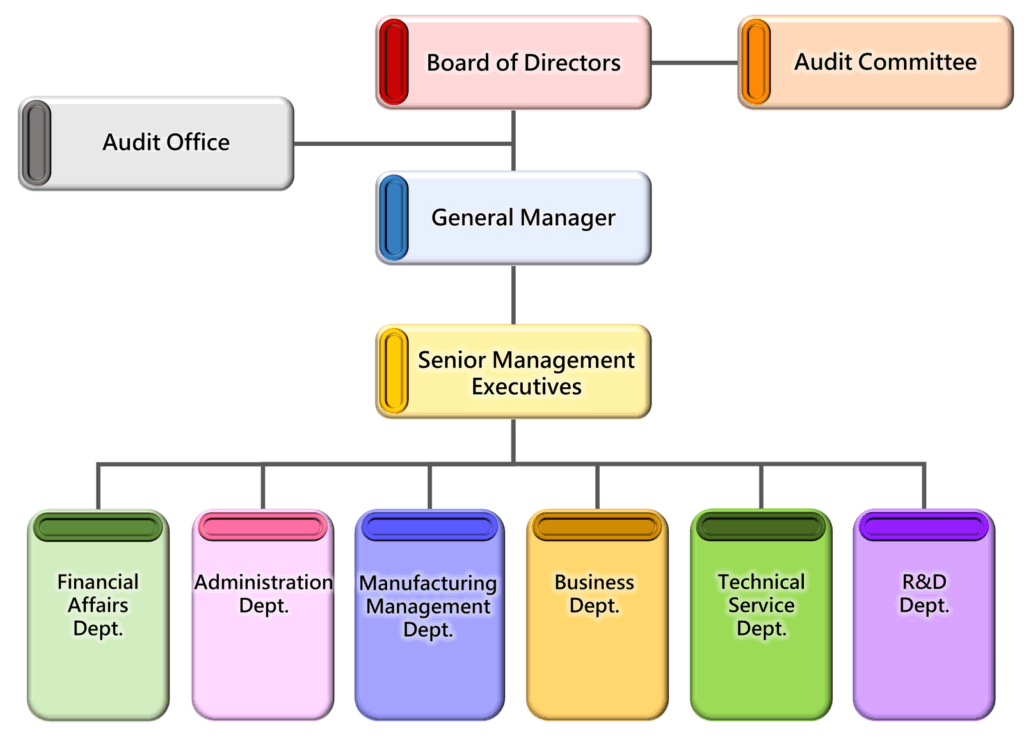

Risk Management Organizational Structure